SEC sues Binance Cryptocurrency Exchange and CEO Changpeng Zhao

On Monday, the U.S. Securities and Exchange Commission filed a lawsuit against Binance, the operating corporation for Binance.US, and Changpeng "CZ" Zhao, the business's founder and CEO, for allegedly breaking federal securities laws.

The lawsuit claims that Binance's staking service breached securities law and that Binance, Binance.US, and CZ provided unregistered securities to the general public in the form of the BNB token and Binance-linked BUSD stablecoin. Similar accusations include failing to register as a clearing agency, a broker, or an exchange against BAM Trading, the business that runs Binance.US, as well as against Binance itself.

Additionally, the SEC claimed that Binance permitted the mixing of customer assets and that CZ was "secretly" in charge of Binance.US and that Binance was being inflated by a CZ-owned and operated business.trade volume in the US.

Additionally, the lawsuit claimed repeatedly that Binance has denied allowing US persons (i.e., US citizens or residents of the US) to trade on its platform.

In order to avoid being subject to U.S. regulation, Zhao and Binance "consistently claimed to the public that the Binance.com Platform did not serve U.S. persons, while concealing their efforts to ensure that the most valuable U.S. customers continued trading on the platform," according to the lawsuit.

"Binance indicated that it was putting measures in place to bar US clients from the Binance.com Platform when the Binance.US Platform launched in 2019. Binance really took the opposite action. As Zhao himself stated, Binance did not want to "be held accountable" for these actions, therefore Zhao authorized Binance to help some high-value U.S. customers get around such controls covertly.

Gary Gensler, the chairman of the SEC, stated in a press statement that "through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of law."

The SEC complaint adds to claims made by the Commodity Futures Trading Commission (CFTC) in March of this year that Binance and its founder Changpeng Zhao knew they were breaking the law by offering unregistered crypto derivatives products in the United States. The CFTC's complaint and many of the SEC's claims are similar.

On Monday, inquiries for comment were not immediately responded to by the SEC or Binance officials.

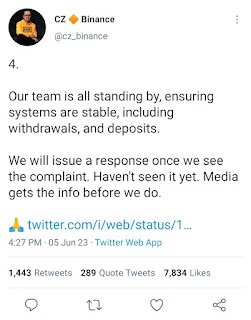

CZ tweeted "4" in response to the news, effectively referring to it as "fud" (fear, uncertainty, and doubt).

No comments: